Solar Panels on Your Roof in South Africa? Here is How to Qualify for a Tax Rebate

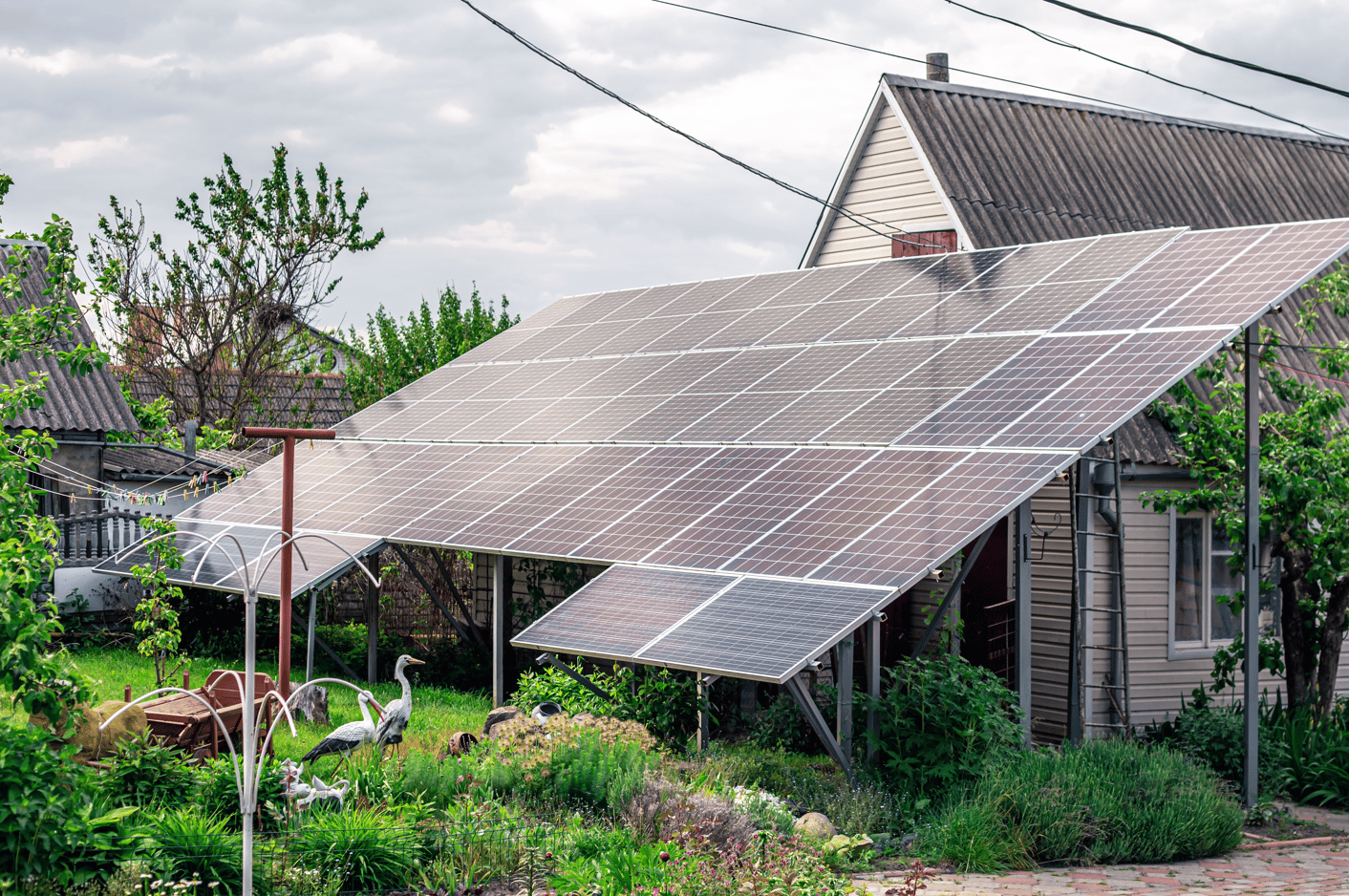

Are you thinking about installing solar panels on your roof? Not only will you be reducing your carbon footprint, but you can also qualify for a tax rebate.

According to the South African Revenue Service (SARS), “you can claim a rebate on your personal income tax if you have installed solar panels on your home or your place of work.” This rebate is known as the Section 12B rebate and is part of the Income Tax Act.

How to Qualify for a Tax Rebate with Solar Panels on Your Roof in South Africa

To qualify for this rebate, your system needs to meet certain requirements. It must be:

- Installed by a qualified installer

- Compliant with South African National Standards (SANS)

- Registered with the City of Cape Town or the South African Photovoltaic Industry Association (SAPVIA)

Once your solar panel system is up and running, you can claim the rebate on your personal income tax return. The rebate amount is equal to 26% of the total cost of the solar panel system, up to a maximum of R1,000,000. This means that if your system costs R100,000, you can claim a rebate of R26,000.

Opportunities for Solar Energy Development in Europe

Not only is installing solar panels a great way to save money on your electricity bill, but it can also benefit the environment. As stated by SARS, “the rebate provides a financial incentive to invest in renewable energy, thereby promoting sustainable development and supporting the country’s efforts to reduce its carbon footprint.”

What are Solar Tax Rebates for South Africa?

As the world is moving towards a sustainable future, many countries have incentivized the use of solar energy. Solar energy is becoming popular in South Africa, and the government has introduced Solar Tax Rebates to encourage its use. In this article, we will discuss what Solar Tax Rebates are and how they work in South Africa.

Solar Tax Rebates are financial incentives provided by the South African government to individuals and businesses that install solar panels to generate electricity. The rebate scheme aims to reduce the cost of implementing solar power systems and promote the adoption of renewable energy.

How do Solar Tax Rebates work?

The South African government offers tax rebates to both individuals and businesses that invest in solar power systems. The rebate amount is calculated based on the size of the solar panel system installed, and it is a percentage of the total cost of the system. The rebate amount can be as high as 50% of the total cost.

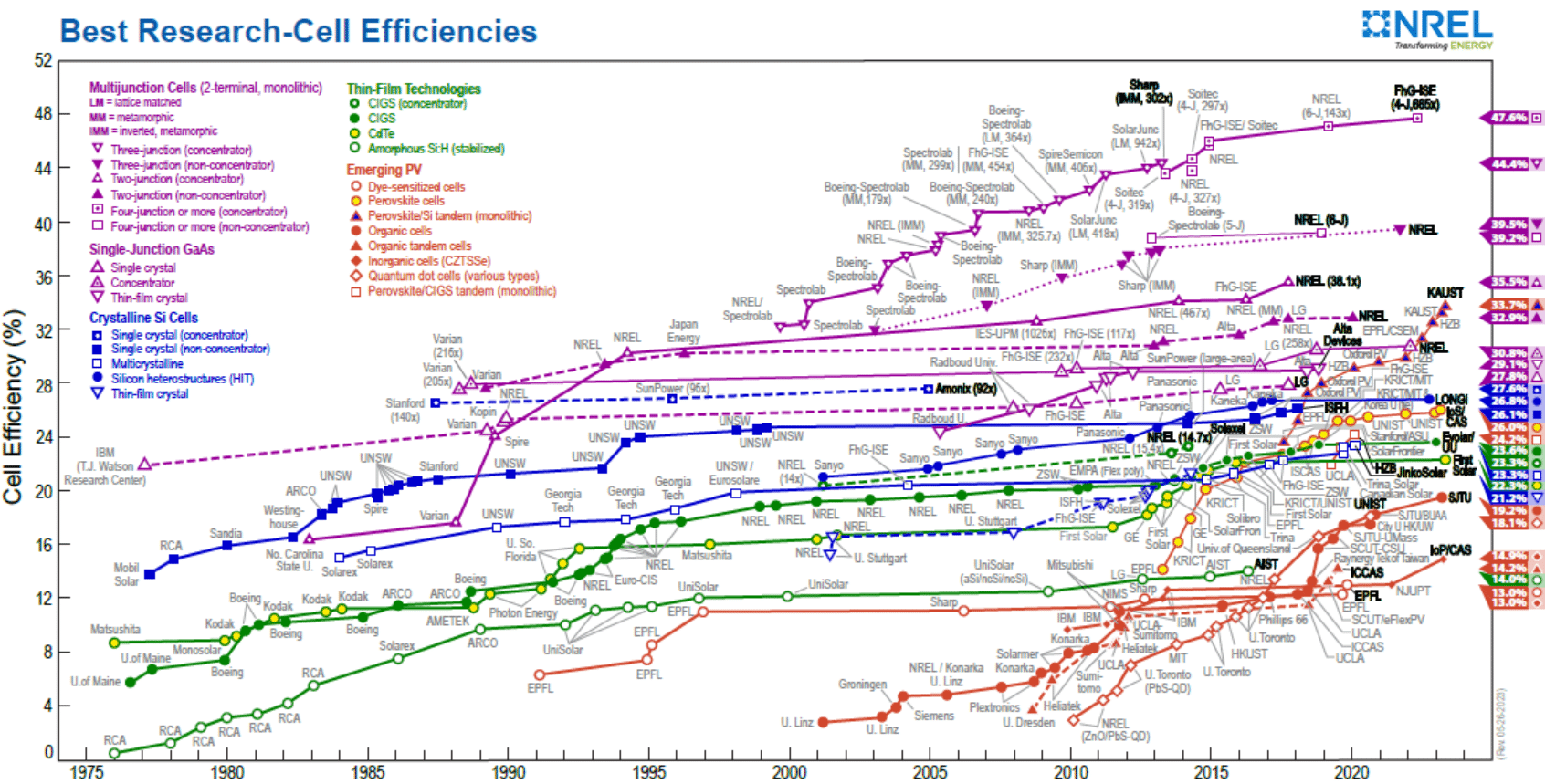

To qualify for Solar Tax Rebates, the solar panel system must meet certain criteria set by the government. These criteria include the solar panel’s efficiency, the type of inverter used, and the installer’s certification.

Benefits of Solar Tax Rebates in South Africa

1. Cost savings: The Solar Tax Rebate scheme aims to reduce the cost of installing solar power systems, making it more affordable for individuals and businesses to switch to renewable energy.

2. Environmental benefits: The use of solar energy helps to reduce the country’s carbon footprint, promoting sustainable development and reducing the nation’s dependence on fossil fuels.

3. Job creation: The Solar Tax Rebate scheme promotes the growth of the solar industry, creating new jobs and contributing to South Africa’s economic growth.

4. Energy security: By promoting the use of solar energy, South Africa can reduce its reliance on imported fossil fuels, increasing energy security in the country.

Conclusion

So, if you’re considering installing solar panels on your roof, don’t forget to take advantage of the Section 12B rebate. Not only will you be doing your part for the environment, but you’ll also be eligible for a tax break.

The Solar Tax Rebate scheme is an excellent initiative by the South African government to promote renewable energy adoption. It offers financial incentives to individuals and businesses that invest in solar power systems, reducing the cost of implementation and promoting sustainable development.

By utilizing solar energy, South Africa can reduce its carbon footprint, create new jobs and increase its energy security.

FOLLOW US ON SOCIAL MEDIA

Follow us on LINKEDIN, FACEBOOK, TELEGRAM GROUP and WHATSAPP.

*** ALSO CHECK: 12 CHALLENGES FACED BY SOLAR COMPANIES IN DEVELOPING COUNTRIES

HOW TO SIZE A SOLAR SYSTEM – 5 clear steps anyone can follow

HOW TO START A SOLAR COMPANY – do these 6 things and make money through solar